Rental property is considered a depreciable asset including major improvements such as new roofs landscaping refrigerators water heaters furniture and so forth.

Roof repair account accounting.

This guide to expensing roofing costs provides tax preparers an outline of questions to ask clients and includes tables to reference when evaluating roof repair costs.

2 the payment for the new roof.

Set up quickbooks done by a quickbooks expert in construction accounting to work specifically for roofing contractors on whatever year and version of quickbooks you own.

Consulting on your needs goals and budget.

A chart of accounts should keep your business accounting error free and straightforward.

Your chart of accounts helps you understand the past and look toward the future.

Your national account team services include.

As your business grows so too will your need for accurate fast and legible reporting.

You should classify as improvement to the property increase the cost of the asset and claim depreciation on the property.

Henry 887 tropi cool 100 silicone white roof coating henry 887 tropi cool 100 silicone white roof coating is a premium 100 silicone moisture cure coating designed to reflect the sun s heat and uv rays as well as protect many types of roofs.

Most roofing contractor quickbooks setup do not work.

You have 2 transactions to address account for.

It is in 2 that you will decide whether this is a maintenance and repair expense or a capital item.

While suitable for use in all climates the 100 silicone chemistry is especially suited for extreme tropical environments which are exposed to some.

Surveys including scientific moisture analysis and evaluation of roof conditions.

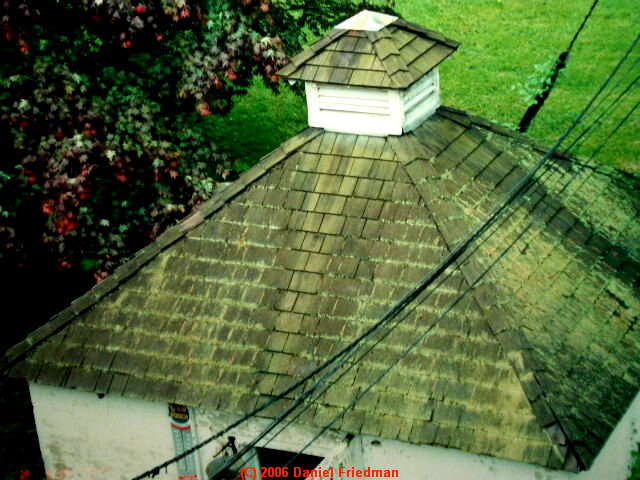

The issue of whether to capitalize or expense a roof repair has been the subject of much tax litigation over the years.

1 the reciept of the insurance proceeds and.

If it is a capital item you will depreciate it.

Accounting software can help manage your chart of accounts.

Analysis a capital improvement is defined as an amount paid after a property is placed in service that results in a betterment adaptation or restoration to the unit of property or building system regs.

Because someone setup quickbooks for your roofing contractor company using the ez step interview in quickbooks the tax accountant or from the notes they took while attending a mind numbing quickbooks class or seminar.

They work closely with you to provide superior service and advice to create cost effective long term solutions for complex roofing and weatherproofing needs.

Unfortunately it has not resulted in any full proof test to determine whether to deduct or capitalize.

Our quickbooks setups and quickbooks chart.